2026 Real Estate Cycles: Your Practical Investment Guide

Real Estate Cycles and How to Profit from Them in 2026

A Practical Guide for RestProperty Investors

The real estate market never moves in a straight line. Periods of growth are followed by pauses, hype gives way to caution, then comes correction, and only then does a new recovery begin. Countries, currencies, and laws change, but one thing remains constant: cycles.

Investors who understand real estate market cycles earn systematically. Those who ignore cyclicality most often buy at the peak of euphoria and become disillusioned during the recession phase. The problem is usually not real estate as an asset class itself, but the wrong entry timing, strategy, and choice of property type.

This material is a practical investment guide for 2026. It is deliberately focused on strategies for earning, preserving capital, and generating yield. It hardly discusses:

- Living by the sea for emotions

- Buying for residency or citizenship

- "Beautiful dreams" of a house in Turkey, Cyprus, or Dubai

These are separate tasks and separate strategies. Below – only investment logic and numbers.

1. What are real estate market cycles?

A real estate market cycle is a recurring sequence of phases the market goes through under the influence of:

- Key central bank interest rates

- Inflation and the speed of its decline

- Credit availability

- Construction volumes and cost of building materials

- Demographics and migration

- Investment demand

In a simplified form, the cycle looks like this:

- Recovery

- Expansion

- Euphoria (overheating, oversupply)

- Recession

After the recession ends, everything starts anew.

Important: The real estate market is inert. What happens in months on the stock market stretches over years in real estate. An entry mistake can "cost" several years of yield.

2. Why understanding cycles is especially important in 2026

Real estate is the most capital-intensive asset in a private investor's portfolio. A mistake in the market phase can easily consume 3-5 years of potential yield.

Real estate is the most capital-intensive asset in a private investor's portfolio. A mistake in the market phase can easily consume 3-5 years of potential yield.

2.1 Buying in the Euphoria Phase

In euphoria:

- Prices are already near peaks

- The market is overheated

- Developers actively use promotions and installment plans to sustain demand

- There are queues in sales offices, news headlines scream "hurry to buy"

Risk for the investor is maximum. But there is one exception.

If the goal is a passport or quick residency through real estate purchase, then entering in the euphoria phase can be justified. In a migration strategy, the main things are:

- Speed

- Legal cleanliness

- Predictable result

Short-term yield is not a priority here.

2.2 Buying in the Recovery and Expansion Phases

These are the strongest phases for capital:

- The central bank rate starts to decrease

- Inflation is going down

- The economy is reviving

- Construction gradually starts, demand grows

It is in these phases that maximum future yield is formed. When buying quality properties, an investor lays the foundation for 30-50% appreciation potential over the cycle.

2.3 Cycles are not an attempt to "guess the market"

Cycles do not promise 100% accuracy. Their task is to give the investor a coordinate system.

A professional investor does not ask: "Will apartment prices in Alanya rise in 2026?"

They ask: "In which phase of the cycle is Turkey currently, and what strategy works here?"

This approach removes chaos and emotions. You are not buying an object; you are buying the right phase, selecting a strategy for it, and adjusting your portfolio as phases change.

3. Macroeconomics and Real Estate: Who Manages the Cycle

The real estate market is always embedded in macroeconomics.

Professionals first look at:

- The key central bank interest rate

- Inflation and the pace of its decline

- Bank mortgage policies

- Construction volumes and developers' land reserves

3.1 How macroeconomics translates into an investor's strategy

It's convenient to view the cycle through a simple table:

| Market Phase | Central Bank Rate | What's Happening in the Economy & Market | Base Investor Strategy |

|---|---|---|---|

| Recovery | Begins to decrease | Economy emerges from slump, market revives, news still "gray" | Buying liquid assets before mass demand |

| Expansion | Low, stable | Sustainable growth, sales accelerate, mortgages accessible | Entering during construction, scaling investments |

| Euphoria | Begins to rise | Overheating, queues in sales offices, lots of advertising | Taking profits, reducing risks |

| Recession | High, strict | Demand falls, promotions and installments appear, some companies close | Focusing on rental income, selective secondary market purchases |

It is the interest rate that sets the market's "temperature."

4. Why the Central Bank Rate Decides Almost Everything

.jpg)

The key interest rate is the cost of money in the economy.

When the rate is lowered:

- Money becomes cheaper

- Mortgages revive

- Developers become active

- Investors withdraw money from deposits

- The market begins to prepare for price increases

When the rate is raised:

- Loans become more expensive

- Demand slows

- Money flows into banking instruments

- Developers delay new projects

- The market cools and gradually transitions to recession

An investor's strategy should start not with the question "where is the apartment," but with "in which phase of the cycle is the country currently?"

A professional buys not square meters. They buy a market phase.

5. Investment Cycles: The Mechanism Step-by-Step

The full cycle looks like this: Recovery → Expansion → Euphoria → Recession.

The order of phases is always the same. Only the duration changes.

5.1 Phase 1. Recovery

The most important and underrated phase.

Signs:

- The central bank rate is already at its peak and begins to decrease

- Inflation is slowing

- The market looks "quiet"

- Few bright news stories

- The number of construction projects is minimal

- Banks are cautious but no longer "hitting the brakes" as hard

What big investors do:

- Enter first

- Take the most liquid property types

- Plan for future yield of 30-50%

What the majority does:

- Reads news that "everything is bad"

- Waits for "clear signals"

- Misses the ideal entry moment

5.2 Phase 2. Expansion

Healthy, sustainable growth.

Signs:

- The rate is already stable at lower levels

- Mortgages become accessible to a wider range of buyers

- The number of construction sites increases

- Demand grows, prices rise steadily

- Interest from foreign investors grows

Professionals:

- Continue buying, but more selectively

- Secure 15-30% yield

- Prepare for future overheating

The Public:

- Finally "believes in growth"

- Actively enters the market

5.3 Phase 3. Euphoria

The most dangerous phase.

Signs:

- Buyers act on emotions

- Prices rise faster than the logic of population income growth

- Queues appear in sales offices

- Developers sell even weak projects

- Media writes "best time to buy, prices are rising"

Professionals:

- Sell

- Transition to cash and less risky assets

- Reduce leverage and liabilities

The Public:

- Takes out expensive mortgages

- Buys "at the peak" to "make it in time"

- Faces long periods of weak yield

5.4 Phase 4. Recession

The phase of cleansing and preparing for a new cycle.

Signs:

- The rate rises sharply

- Loans become expensive

- Some developers go bankrupt or freeze projects

- Promotions and aggressive installment plans appear

- News is full of words like "crisis," "slump," "crash"

Professionals:

- Do not sell in panic

- Maintain liquidity

- Wait for the first signs of recovery

The Public:

- Realizes losses

- "Vows" not to invest in real estate

- Concludes "the market is dead," typically right at the bottom

6. How to Understand Which Phase a Country is In

In practice, an investor needs two indicators.

In practice, an investor needs two indicators.

6.1 Central Bank Interest Rate

- Rising → Market moving towards recession

- Remains high for a long time → Recession in active phase

- Begins to decrease → Recovery has started

- Stably low → Expansion

6.2 Media Rhetoric

- Headlines "crisis, decline, slump" – usually this is already late recession or early recovery

- "Market reviving, sales growing" – early expansion

- "Record prices, demand breaking records" – late expansion or euphoria

The media always lags behind reality by 6–18 months. Professional investors earn precisely in this "delay window."

7. Example: Turkey at the Turn of 2025-2026

.jpg) From a cycle perspective, Turkey is one of the most illustrative markets for investors in 2026.

From a cycle perspective, Turkey is one of the most illustrative markets for investors in 2026.

Facts at the end of 2025:

- The central bank rate, after a record 50%, was lowered to 38%

- Inflation slowed to around 30.9% per year

- The housing market showed a record volume of transactions, although real prices adjusted for inflation

- Developers are cautiously increasing construction, but far from euphoria

What this means by phases:

- The peak rate has passed – the recession bottom is behind

- The first and second rate cuts – a signal of recovery start

- With the continuation of the downward trend, the rate in 2026–2027 will drop further, pushing the market into the expansion phase

Media Picture:

- Many media still write "market weakening," "demand declining," "crisis has come"

- This is the language of recession, although recovery has already begun

Important:

- We are not waiting for recovery in the future

- Recovery is happening right now, it just hasn't entered the mass picture yet

For an investor, 2026 in Turkey is the early stage of recovery. That is the entry point that major investors usually do not miss.

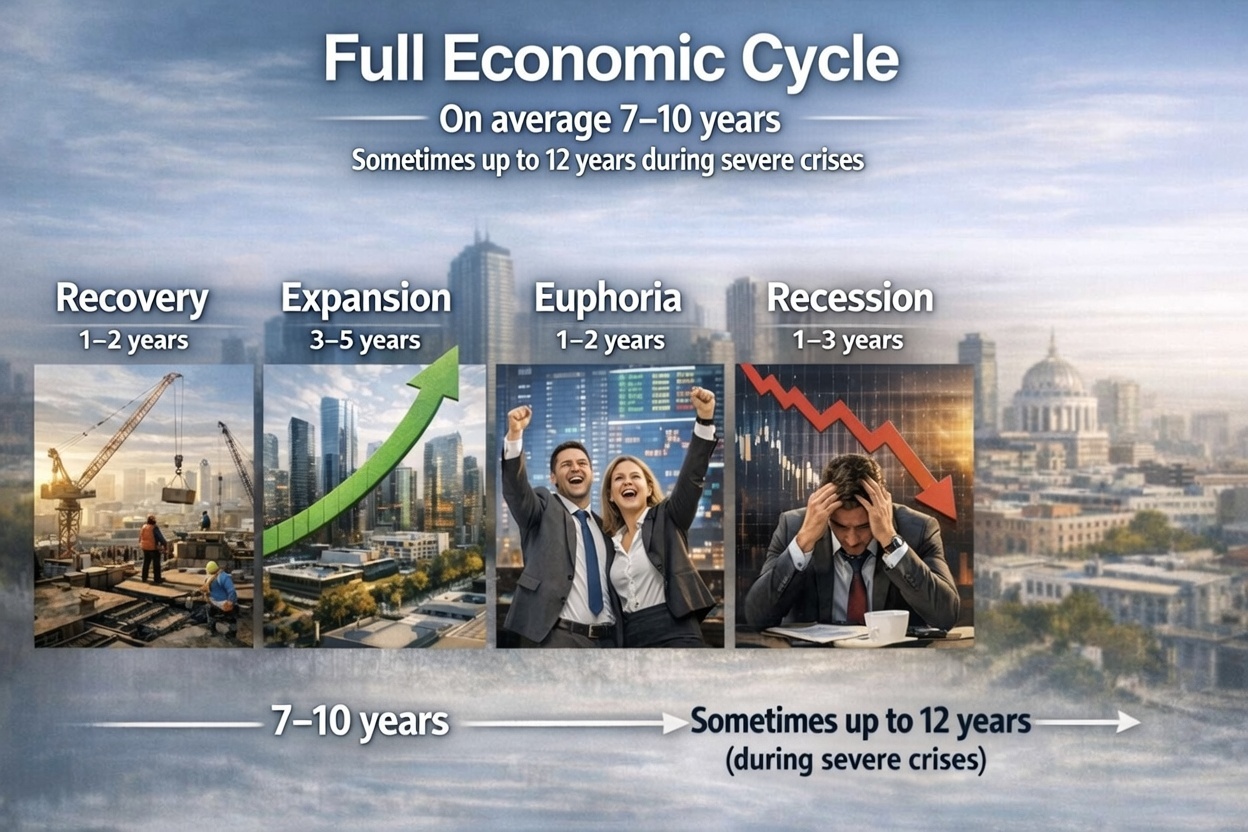

8. How Long Does an Investment Cycle Last?

.jpg) Average phase estimates:

Average phase estimates:

- Recovery – 1–2 years

- Expansion – 3–5 years

- Euphoria – 1–2 years

- Recession – 1–3 years

A full cycle usually takes 7–10 years. During deep crises, it can stretch to 12 years.

Three key formulas to keep in mind:

- Peak interest rate = Recession bottom

- First rate cut = Start of recovery

- Mass media positivity = Late stage of the cycle

9. How RestProperty Applies Cycles in Practice

.jpg) RestProperty has been operating in the real estate market since 2003 and has gone through several full cycles in Turkey, Northern Cyprus, Dubai, and Thailand. These include periods:

RestProperty has been operating in the real estate market since 2003 and has gone through several full cycles in Turkey, Northern Cyprus, Dubai, and Thailand. These include periods:

- After the 2008 global crisis

- Active growth 2016–2019

- Turbulence 2020–2023

- Severe recession and the current transition to recovery

Our principle is not to sell "pretty pictures," but to work with the cycle.

What this means in practice:

- We track central bank decisions and macro indicators

- We select property types that work in a specific phase (currently recovery)

- We focus on rental income and long-term object value

- We diversify by country: Turkey, Dubai, Phuket, Northern Cyprus

You can verify us through public documents:

And if the founder matters to you, check out Nihat Tufan’s profile: a market practitioner, not just theory.

10. Cycles and Migration Strategies: Where is the Safety?

There are no countries with "eternal guarantees" in the world. Any economy goes through the four stages: Recovery, Expansion, Euphoria, Recession.

There are no countries with "eternal guarantees" in the world. Any economy goes through the four stages: Recovery, Expansion, Euphoria, Recession.

The most conflict-prone phase is Recession. It is during this period that states:

- Revise residency programs

- Tighten requirements

- Pause document processing

- Restrict foreigner transactions

- Sometimes temporarily freeze deals in certain regions or property types

It is important to understand: this is not a "fight against specific nationalities." It is a standard way to protect the macroeconomy and currency during a difficult period.

Therefore, any migration strategy should start with answering the question: "Why do I need this property?"

10.1 If the goal is Permanent Residency and a second passport

The strategically correct goal is to move towards a passport, not just a residency card.

A passport:

- Is independent of the current cycle phase

- Protects status and property ownership

- Allows you to calmly wait out recessions

If you already have a second passport, a recession turns from a safety question into a question of economic discomfort and yield. It's a different psychology.

10.2 If the goal is investment

The rational model is the same for any country:

- Buy in the recovery phase, when maximum future yield is formed

- Sell in the euphoria phase, securing profit

- During recession, work with deposits, bonds, and highly liquid properties

- Re-enter real estate on the next recovery cycle

This is how professional investors work all over the world – from London and Dubai to Alanya and Phuket.

10.3 If you need a "safe haven"

In this case, the strategy combines migration and investment:

- Live in the country for 6–8 years – from recovery to late expansion

- In the phase of severe recession, have an alternative destination (another country, island, European city)

- Maintain status and freedom of movement regardless of the decisions of a specific government

Therefore, a professional migration strategy always has a Plan "B".

11. Strategies for 2026–2028: What to Buy and Where

.jpg) Considering the cycle "Turkey is entering the recovery phase," the basic logic for an investor in 2026–2028 looks like this.

Considering the cycle "Turkey is entering the recovery phase," the basic logic for an investor in 2026–2028 looks like this.

11.1 Formats for the Recovery Phase

Currently interesting:

- Liquid 1+1 and 2+1 apartments in complexes with infrastructure

- Properties near the sea for short-term rental or in areas with infrastructure and steady demand for long-term rental

- Finished apartments or those at a high stage of completion

- Limited formats: garden duplexes, rare property types, sea view

Main Markets:

- Turkey – Resort real estate in Alanya, Antalya, Mersin, Istanbul, Bodrum

- Dubai – "Dubai property for investment 2026" with a long global trend

- Asia – Phuket and Thailand as a market for "villa with income"

- Northern Cyprus – A long-term bet on a growing resort region

11.2 Which markets to look at

The cycle is the same, but:

- Turkey offers a lower entry barrier and strong rental demand

- Dubai offers high transparency and global liquidity

- Phuket/Thailand – tourist flow and managed villas

- Northern Cyprus – a bet on long-term growth and a still low base

RestProperty works with all these destinations, but we always build strategy from the cycle, not from a "trendy city."

12. Risks and Uncertainties: What to Honestly Remember

No forecast guarantees a perfect scenario. For 2026–2028 for Turkey and comparable markets, there are key risks:

- Domestic politics and elections

- Regional geopolitics

- Global crises and commodity market volatility

- Inflation spikes and a possible pause in rate cuts

- Local regulatory decisions concerning foreigners

An investor cannot control these factors. But they can:

- Diversify by country and currency

- Choose properties that hold value and generate profit in the long term, even in a weak market

- Build in a liquidity buffer

- Avoid overheated locations and "fairy-tale" yield promises

13. Bottom Line: Who Wins in 2026

In 2026, investors who win are those who:

In 2026, investors who win are those who:

- Understand which phase of the cycle their country of interest is in

- Choose a strategy according to the cycle, not advertising

- Look at the central bank rate and macro data, not just the view from the window

- Work with professionals who have lived through several cycles, not one "hyped" year

RestProperty helps investors not to guess the market, but to earn consciously within it, fitting each purchase into the cycle.

If you want to analyze your situation, country, budget, and planning horizon, contact us, and we will propose a specific scenario for your request – from an apartment for income in Alanya to a villa in Dubai or Phuket.

FAQ on Real Estate Market Cycles – 2026

A real estate market cycle is a repeating sequence of phases: Recovery, Expansion, Euphoria, Recession. Markets grow in some years and slow or correct in others, influenced by central bank rates, inflation, construction, and demand.

Tip: Understanding the cycle helps investors pick the right moment and avoid buying at the peak.

Average cycle: 7–10 years, sometimes up to 12 during extended recessions.

- Recovery: 1–2 years

- Expansion: 3–5 years

- Euphoria: 1–2 years

- Recession: 1–3 years

Tip: Focus on identifying the current phase rather than exact timing.

The key rate is the cost of money:

- High rate → loans expensive → demand cools → recession

- Lowering rate → recovery starts → mortgages revive → money flows into real estate

Cycle formula: Peak rate ≈ recession bottom; first cut ≈ start of recovery

Yes, but strategy differs by phase:

- Recovery: Buy liquid properties with growth potential (Low risk)

- Expansion: Enter during construction, secure growth (Medium risk)

- Euphoria: Sell, reduce risks (High risk)

- Recession: Focus on rental, selective purchases (Medium risk)

Common mistake: Using the same strategy in all phases.

Investment strategy: Yield, capital growth, horizon 3–7 years, enter in Recovery/Early Expansion.

PR/Citizenship strategy: Legal status, safety, long-term horizon, enter in any phase.

Conclusion: Passport goals may justify buying even in euphoria; yield-focused investors should avoid peaks.

Indicators:

- Central bank rate: Rising → recession approaching; High/stable → slowdown; Decreasing → recovery; Low/stable → expansion.

- Media/news: "Crisis" → late recession/early recovery; "Market reviving" → early/mid expansion; "Boom" → late expansion/euphoria.

Pro tip: News lags 6–18 months; smart investors earn in this "delay window."