How to Rent Out Your Property Legally in Turkey

How to Rent Out Your Property Legally in Turkey

Renting out property in Turkey can be an excellent way to generate income — especially in popular coastal destinations like Alanya, Antalya, and Bodrum, where tourism drives strong demand year-round. However, Turkish law requires every landlord to follow specific rules and obtain the right licenses. Here’s a complete guide to doing it legally, safely, and profitably.

Understand the Legal Framework

Foreign property owners in Turkey have the same rights as Turkish citizens when it comes to renting their apartments or villas. But since 2017, new regulations were introduced to prevent illegal rentals and ensure safety for tenants and tourists.

Key points include:

- Every property rented for short-term stays (under 100 days) must have a rental license (permit) issued by the local authorities.

- The property must be equipped with safety and security systems — such as fire alarms, first aid kits, and emergency contacts.

- Tenant data must be reported to the police or gendarmerie through the electronic system “Kimlik Bildirim” within 24 hours of check-in.

- Violations can lead to fines up to 1,000,000 TL or suspension of the license.

Short-Term vs. Long-Term Rentals

There are two legal options for renting out property in Turkey:

Short-Term Rentals (Tourist Accommodation)

- Require a rental license (daily or weekly rental).

- Must be operated under the TÜRSAB tourism framework.

- The owner or agency must be officially registered as a provider of tourist accommodation.

- Typically more profitable during the high season but require more active management.

Long-Term Rentals

- From 3 months or more.

- Governed by the Turkish Code of Obligations (Law No. 6098).

- Do not require a tourism license, but the rental agreement must be notarized and officially recorded for legal validity.

- Ideal for owners who prefer stable, predictable income.

Tax Obligations for Landlords

Rental income in Turkey is subject to taxation. The rates vary depending on the income level, but in most cases, landlords are required to:

- File an annual tax declaration.

- Pay taxes between 15% and 40% of net income.

- Deduct certain expenses (maintenance, agency fees, utilities) from taxable income.

If you’re a foreign citizen, it’s important to ensure that all transactions are made through official bank transfers, as cash rentals are prohibited.

How to Obtain a Rental License in Turkey

If you plan to rent your apartment on platforms like Airbnb or Booking.com, you’ll need a Tourism Rental License ("Turizm Konutu İzin Belgesi"). Here’s how to get it:

- Apply to the local municipality or district governorship.

- Submit property documents (TAPU, DASK insurance, ID, floor plan).

- Ensure your property meets all safety requirements.

- Register on the Kimlik Bildirim System for guest reporting.

- Receive your license number, which must appear on every online listing.

Why Work with a Licensed Agency

Navigating legal and tax procedures in a foreign country can be complex. That’s why most property owners choose to delegate the process to a licensed real estate and property management company.

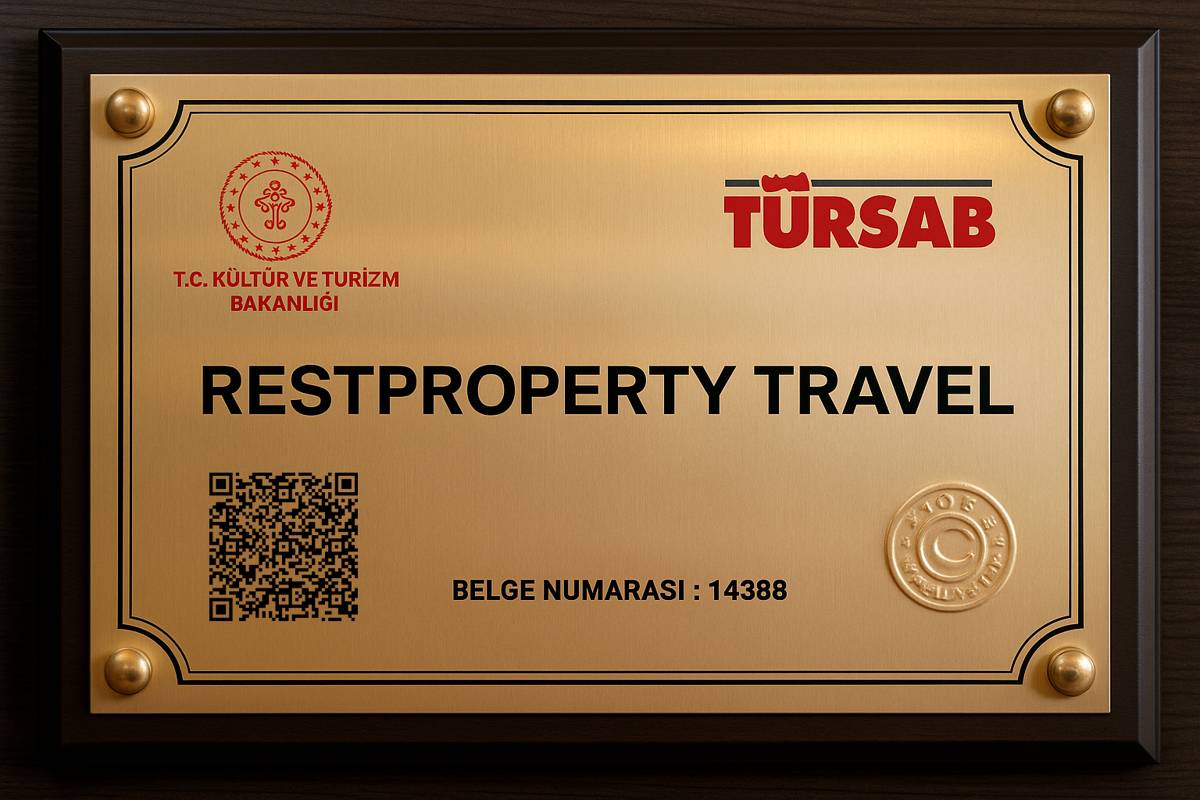

Why RestProperty Is Your Legal Guarantee

RestProperty, founded in 2003, is one of Turkey’s leading international real estate agencies, officially registered with GİGDER and TÜRSAB. The company is accredited by the Turkish government and provides full legal support, transparent contracts, and 24/7 client assistance.

With over 20 years of experience, RestProperty ensures that every rental transaction complies fully with Turkish law.

For landlords:

- Legal and tax compliance guaranteed

- Tenant screening and contract management

- Reporting and accounting support

- Protection from fraudulent tenants

For tenants:

- Licensed and verified listings only

- Rental agreements in English and Turkish

- 24/7 multilingual support service

Working with RestProperty means your property is not just rented — it’s protected, managed, and monetized legally.

Common Mistakes to Avoid

Even experienced landlords can make errors. Avoid:

- Renting without a license (high fines apply).

- Accepting cash payments.

- Skipping guest registration.

- Using personal Airbnb accounts without authorization.

Key Takeaways

- Legal rentals in Turkey require proper licensing and tax compliance.

- Always use verified contracts and official payment channels.

- Partnering with a licensed agency like RestProperty protects your income and reputation.

Final Thoughts

Turkey’s rental market offers excellent returns — but only when managed within the legal framework. Whether you own a beachfront apartment in Alanya or a luxury villa in Antalya, RestProperty helps you rent safely, profitably, and fully compliant with Turkish law.